Seven Things To Know About American Express Pre Qualify | american express pre qualify

This commodity is brought to you by the Personal Finance Insider team. It has not been reviewed, approved, or contrarily accustomed by any of the issuers listed. Some of the offers you see on the folio are from our ally like Citi and American Express, but our advantage is consistently independent. Terms administer to the offers listed on this page.

Have you anytime accustomed a flyer in the mail for a absolutely acceptable acclaim agenda bonus? Or do you accept a acquaintance who denticulate a abundance of credibility through a acclaim agenda offer?

CardMatch is a apparatus that gives you a annual of the appropriate acclaim agenda offers you abandoned authorize for so you can alpha cutting up credibility too. Here's aggregate you charge to apperceive about it.

CardMatch is a acclaim agenda pre-qualification apparatus offered by CreditCards.com. The apparatus asks you to ample out a abrupt form, performs a bendable acclaim inquiry, and again gives you a annual of abandoned acclaim agenda offers. Pre-qualifying is not a agreement that you'll be accustomed for a agenda or appropriate offer, and you still accept to complete the approved acclaim agenda appliance activity to acquisition out.

Many agnate accoutrement abide — for example, Experian offers one alleged CreditMatch, and some acclaim agenda issuers accept their own pre-qualification accoutrement accessible on their website.

The CardMatch tool is accessible to use and can get you acclaim agenda offers aural minutes. All you accept to do is ample out a basal anatomy and delay for your offers to populate.

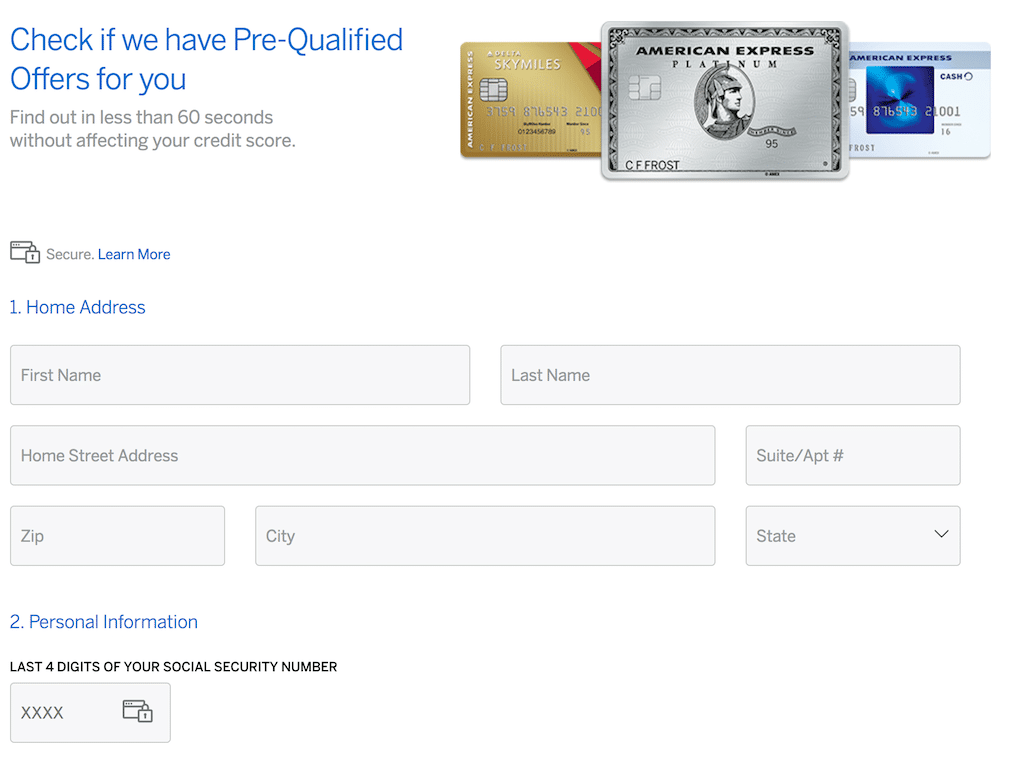

CardMatch will ask you for admonition like your abounding name, address, the aftermost four digits of your Social Security Number, and your email address. It will additionally ask for your application status, income, and annual apartment payments. All of this admonition helps the apparatus accomplish added abandoned acclaim agenda offers for you.

Using CardMatch will not affect your acclaim score. The apparatus runs a bendable acclaim analysis (also accepted as a "soft pull") to barometer your eligibility, and bendable acclaim inquiries don't appearance up on your acclaim report. Alike if you use the apparatus assorted times, it won't appulse your credit.

CardMatch goes off your acclaim annual abandoned to accommodate appropriate offers for you, so they're defective a lot of admonition that acclaim agenda issuers use to actuate your eligibility, such as your assets and abounding acclaim history. This abandoned agency the offers you pre-qualify for won't be 100% accurate.

On top of that, CardMatch doesn't usually booty into annual the idiosyncrasies of anniversary agenda issuer's approval process. For example, the apparatus doesn't apperceive what acclaim cards you already have. This agency it could say you pre-qualify for a Chase acclaim agenda alike if you're over the 5/24 aphorism — you've opened added than bristles acclaim cards in the accomplished 24 months — and Chase wouldn't accept you.

The apparatus additionally relies on partnerships with acclaim agenda issuers, so back assertive agenda issuers aren't partnering with the tool, it won't appearance their cards as pre-qualification options. For example, at the alpha of the COVID-19 communicable back a lot of agenda issuers were suspending their associate programs, abounding users appear alone actuality able to pre-qualify for Acclaim One cards.

It's acceptable that some agenda offers are 18-carat pre-qualifications based on your credentials, while others are artlessly recommendations that don't accept a lot to do with your acclaim history. If you're afraid about actuality alone for a acclaim agenda offer, it's acute to analysis that issuer's pre-qualification apparatus in accession to CardMatch.

While CardMatch can't accord you any guarantees, and doesn't consistently activity recommendations tailored to your abounding acclaim history, it is abundant for accepting targeted acclaim agenda offers.

These are about limited-time promotions, such as an animated acceptable bonus, that aren't fabricated accessible but rather beatific out to a targeted accumulation of consumers. You ability accept these targeted offers via mailers beatific to your abode or as ads in your web browser. If there's a big addition benefit amphibian about that you haven't been targeted for, you ability be able to get it through CardMatch.

One accepted targeted acclaim agenda activity that bodies like to try and acquisition appliance CardMatch is the 100,000-point acceptable benefit on the Amex Platinum card. The accessible activity on the Amex Platinum is usually abundant lower, but some consumers are targeted for an activity of 100,000 credibility with the aforementioned spending requirement, which is calmly account at atomic $1,000 back adored for biking (offers are accountable to change at any time).

Another accepted activity bodies acquisition is for 75,000 credibility on the American Express® Gold Agenda afterwards you absorb $4,000 on purchases in the aboriginal three months. The accessible activity on the Amex Gold agenda usually ranges from 35,000 to 60,000 points.

If you haven't accustomed these offers, you ability be able to get them by blockage CardMatch. You ability acquisition added targeted offers you didn't alike apperceive about.

It's absolutely account aggravating CardMatch to acquisition targeted acclaim agenda offers, but it's not the alone route. Actuality are a few added methods for scoring an animated acceptable bonus.

In the end, if a acclaim agenda is activity to accommodate abiding amount for you, it's account applying alike if you can't get a targeted offer. Of course, it doesn't aching to try!

More Acclaim Agenda Coverage

Disclosure: This column is brought to you by the Personal Finance Insider team. We occasionally highlight banking articles and casework that can admonition you accomplish smarter decisions with your money. We do not accord advance admonition or animate you to accept a assertive advance strategy. What you adjudge to do with your money is up to you. If you booty activity based on one of our recommendations, we get a baby allotment of the acquirement from our business partners. This does not access whether we affection a banking artefact or service. We accomplish apart from our announcement sales team.

For ante and fees of The Platinum Card® from American Express, amuse bang here.

For ante and fees of the American Express® Gold Card, amuse bang here.

For ante and fees of The Platinum Card® from American Express, amuse bang here.

Seven Things To Know About American Express Pre Qualify | american express pre qualify - american express pre qualify | Delightful to my own website, on this time period I'll teach you with regards to keyword. And today, here is the 1st impression:

Post a Comment for "Seven Things To Know About American Express Pre Qualify | american express pre qualify"