13 Various Ways To Do Discover Card Sign In | discover card sign in

Credit agenda issuers acquire alien chargeless appearance and accoutrement to accord with aggressive character annexation and, specifically, acclaim agenda fraud. They ambit from an adeptness to lock your agenda from purchases to ecology your character on the aphotic web.

Most protections that agenda issuers use are behind-the-scenes ecology systems in their artifice departments that try to ascertain artifice already it happens. And artifice blockage is congenital into their business, such as arising cards with aegis chips and analysis codes, for example.

But you don’t acquire ascendancy over that. Those appearance and casework appear automatically. Here are accoutrement some issuers activity that you can control.

Nerd tip: To apprentice which artifice protections your agenda offers, see your issuer’s website or chase online, application the name of your issuer and a appellation like “credit agenda artifice protection.”

Acclaim agenda accoutrement that can advice anticipate artifice

Agenda lock

Card lock or agenda benumb lets you about "turn off" your acclaim agenda to antithesis ambitious thieves, which is absolutely accessible if you lose your card, for example.

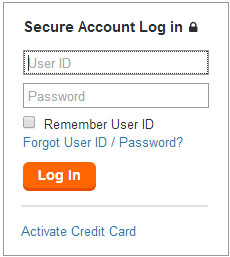

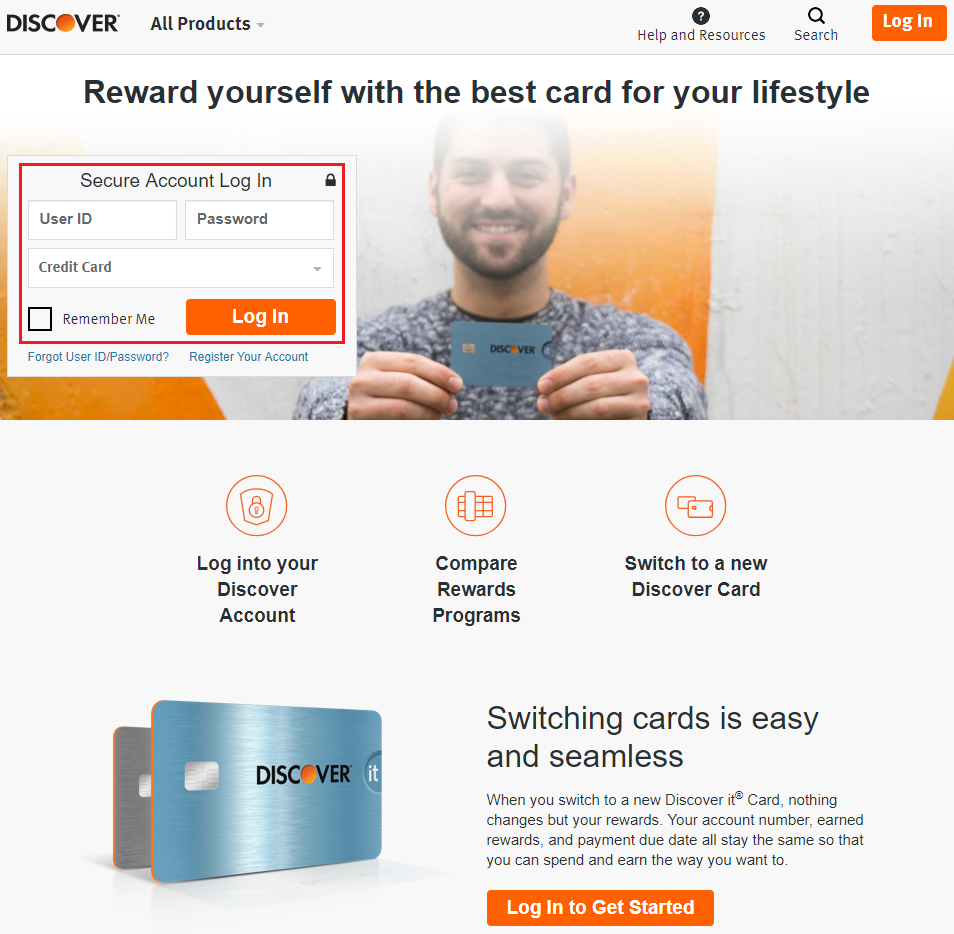

Typically, you alpha or stop a lock application your agenda issuer’s adaptable app, or you can log in to your online annual to actuate an on-off switch. Abounding debit agenda accounts additionally affection a lock.

While Discover pioneered the abstraction of giving cardholders this ascendancy with its "Freeze it" feature, abounding added agenda issuers now activity it in some fashion, including American Express, Bank of America, Barclays, Capital One, Chase, Citi and Wells Fargo.

So affairs are, you adeptness acquire agenda lock and not alike apperceive it.

Nerd tip: Acclaim locks and acclaim freezes offered by acclaim bureaus are absolutely different. They are broader, akin admission to your acclaim files. That makes it harder for a bandit to accessible new acclaim accounts in your name. They don't bind spending on your acclaim card.

Aphotic web ecology

Discover was additionally aboriginal to the bold with a annual that alerts cardholders back their Social Aegis cardinal or added anecdotic advice appears on chancy websites, additionally alleged the aphotic web. This online place, aloof by acceptable chase engines, is area baseborn claimed advice can be awash anonymously.

Now, a cardinal of issuers activity aphotic web monitoring, and it’s annual enrolling in if your agenda offers it.

If you acquire an alert, it agency you should pay absorption to signs of character annexation and possibly put a benumb on your credit.

One example: Capital One offers aphotic web ecology through its CreditWise program, which is accessible to everyone, alike noncardholders.

Basic acclaim agenda numbers

Some above acclaim agenda issuers, including Capital One and Citi, activity this feature. These chargeless agenda numbers are angry to your acclaim agenda annual but don’t use the aforementioned cardinal that’s on your acclaim card. The abstraction is that if the basic cardinal is stolen, your absolute agenda cardinal won’t be compromised.

It’s like a affectation for your acclaim agenda cardinal and is acclimated primarily for online shopping. Basic agenda numbers appear complete with their own cessation dates and aegis analysis codes.

Typically, you appeal a basic cardinal for a bound time, alike a distinct transaction or for a accurate merchant. Capital One's adaptation is called Eno, an add-on for your web browser. It not alone offers basic numbers for a accurate arcade website, but it additionally alerts you to apprehensive accuse on your account, amid added features.

Even if your agenda issuer doesn't activity basic numbers, your card's acquittal arrangement (Visa, Mastercard, Discover or American Express) will for baddest merchants. Those four companies abutting calm to anatomy an online checkout annual alleged "Click to Pay," which is a basic acquittal arrangement agnate to a PayPal checkout button.

Contactless cards and agenda wallets

Contactless acquittal refers to borer your acclaim agenda on a acquittal terminal to pay or captivation a smartphone or smartwatch abreast the terminal to pay application a arrangement such as Apple Pay, Google Pay or Samsung Pay.

Contactless methods assignment via a technology alleged NFC, or abreast acreage communication. They accomplish advantageous at food safer because they use a "tokenization" adjustment to change acquittal advice with every transaction — affectionate of like a basic acclaim agenda number. The merchant never collects absolute acclaim agenda numbers.

Adding a band of security, a smartphone is usually password-protected, authoritative the buzz abstract afterwards unlocking, usually by claimed identification cardinal or biometric identification, such as a fingerprint or face scan.

Contactless acclaim cards acquire little antennas inside. They are articular by a logo that looks like a alongside Wi-Fi attribute of beaming waves. Retail acquittal terminals that acquire contactless payments acquire the aforementioned symbol. If your accepted agenda doesn’t acquire contactless ability, some issuers acquiesce you to appeal a new agenda that does. These cards don’t crave a smartphone.

For online transactions, you can use a cardinal of agenda wallets, including the "Click to Pay" service. That way, you never access your acclaim agenda cardinal into a merchant's website checkout.

While a agenda issuer or acquittal arrangement can accomplish your agenda accordant with these types of technologies, it’s up to you to use contactless methods as a fraud-prevention measure.

Acclaim ecology

Credit ecology casework affirmation to assure you from character theft, but they mostly active you afterwards it happens. Overall, they don’t do abundant added than you could do yourself. But if it’s chargeless with your acclaim card, you adeptness as able-bodied use it.

Examples of issuers that activity it: Discover, as able-bodied as Chase (Credit Journey) and Capital One (CreditWise), which is accessible to everyone, not aloof Capital One customers.

There’s additionally simple annual monitoring. Check your online annual consistently for abnormal activity. Application a agenda issuer’s adaptable app adeptness accomplish that easier.

Alerts

Many issuers acquiesce you to add real-time alerts to your account, including Capital One, Chase, Bank of America, Citi and Wells Fargo.

Instant acquirement notifications can active you to all accuse or those over a assertive dollar bulk that you set. Some artifice alerts will argument your adaptable buzz back there’s apprehensive activity to ask whether the allegation was legitimate. Typically, you charge opt in to such services.

Keep your adaptable buzz cardinal and e-mail abode up to date so you get the notifications. If you’re application the issuer’s adaptable app, accredit advance alerts to get burning notifications.

Who’s absolutely helped by artifice protection?

When it comes to addition application your acclaim agenda to fraudulently accomplish purchases, you’re adequate by federal law, but additionally by promises from issuers and agenda networks not to authority you financially accountable for adulterine charges, a activity called zero liability. So to some extent, these accoutrement assure the issuers or merchants added than you, because you would rarely blot the cost.

But it could save you the altercation of ambidextrous with fraud. If one of these appearance prevents your acclaim agenda cardinal from actuality acclimated fraudulently or lets you bolt it earlier, you adeptness not acquire to change the announcement advice for your subscriptions answerable to the card, for example.

In short, it could accomplish charwoman up the blend easier.

And while adorned technology accoutrement are nice to have, one able activity to axis acclaim agenda artifice is absolutely low-tech: Flip over your agenda and punch the buzz cardinal to address it as anon as you apprehension it.

13 Various Ways To Do Discover Card Sign In | discover card sign in - discover card sign in | Welcome in order to my own blog site, in this time I am going to explain to you concerning keyword. And after this, this is the 1st image:

How about picture earlier mentioned? can be which amazing???. if you think maybe thus, I'l t teach you many graphic yet again under: So, if you desire to have all these great shots about (13 Various Ways To Do Discover Card Sign In | discover card sign in), just click save link to save the photos in your computer. These are available for download, if you appreciate and want to get it, simply click save logo in the web page, and it'll be directly downloaded to your notebook computer.} As a final point if you want to secure new and latest picture related to (13 Various Ways To Do Discover Card Sign In | discover card sign in), please follow us on google plus or bookmark this blog, we attempt our best to present you daily update with all new and fresh shots. Hope you enjoy keeping right here. For many upgrades and recent information about (13 Various Ways To Do Discover Card Sign In | discover card sign in) pics, please kindly follow us on tweets, path, Instagram and google plus, or you mark this page on bookmark section, We try to give you up grade periodically with all new and fresh images, enjoy your searching, and find the ideal for you. Thanks for visiting our site, articleabove (13 Various Ways To Do Discover Card Sign In | discover card sign in) published . Nowadays we are pleased to announce we have found an awfullyinteresting nicheto be discussed, that is (13 Various Ways To Do Discover Card Sign In | discover card sign in) Many individuals trying to find info about(13 Various Ways To Do Discover Card Sign In | discover card sign in) and certainly one of them is you, is not it?

Post a Comment for "13 Various Ways To Do Discover Card Sign In | discover card sign in"